What is the difference between balance and available balance? Stanford Federal Credit Union

The article was reviewed, fact-checked and edited by our editorial staff prior to publication. But our Balance After Bills feature brings you an even clearer understanding of your finances. It takes into account regular outgoings, such as standing orders and Direct Debits and estimates your likely balance after those bills.

ways to get a free bank account

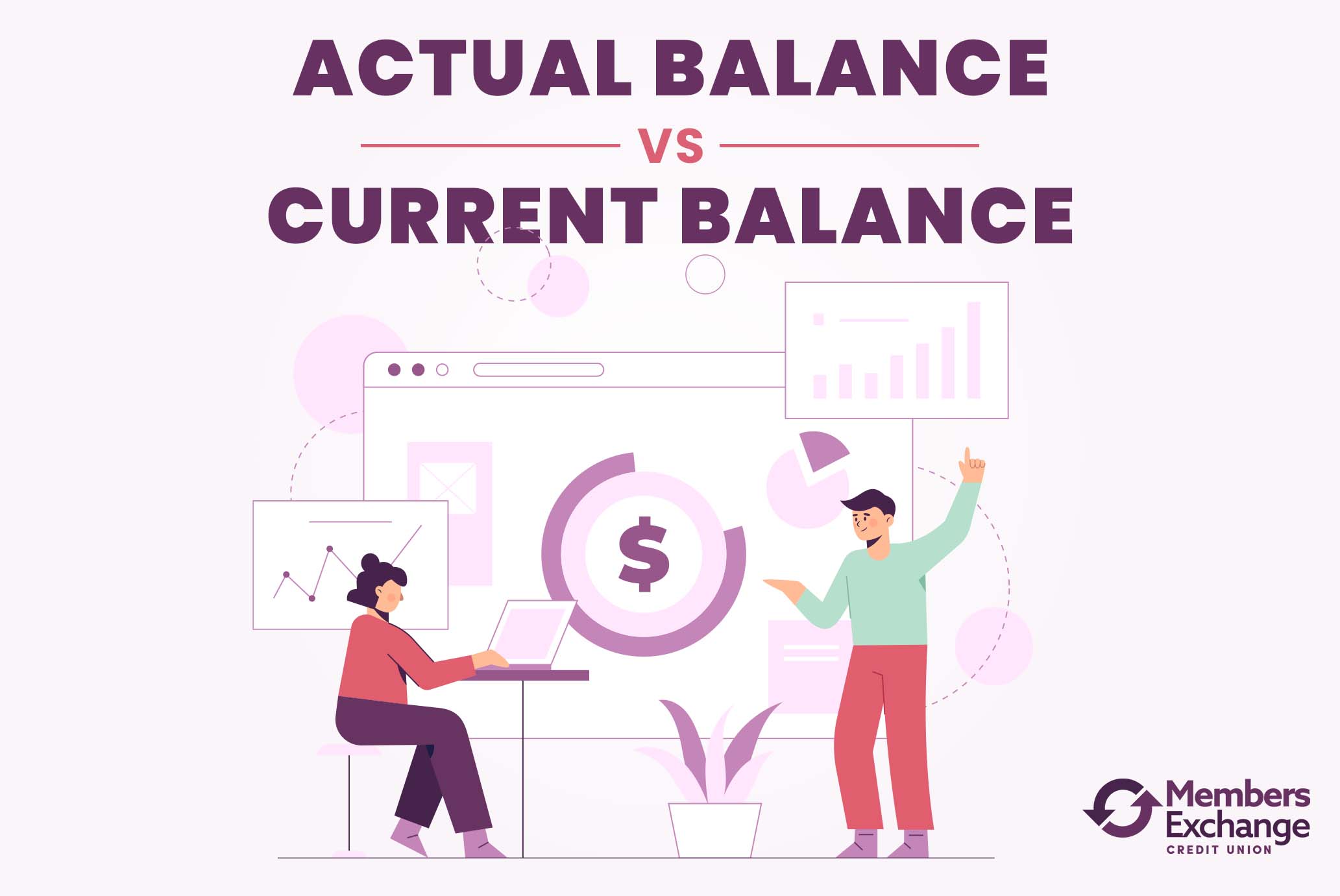

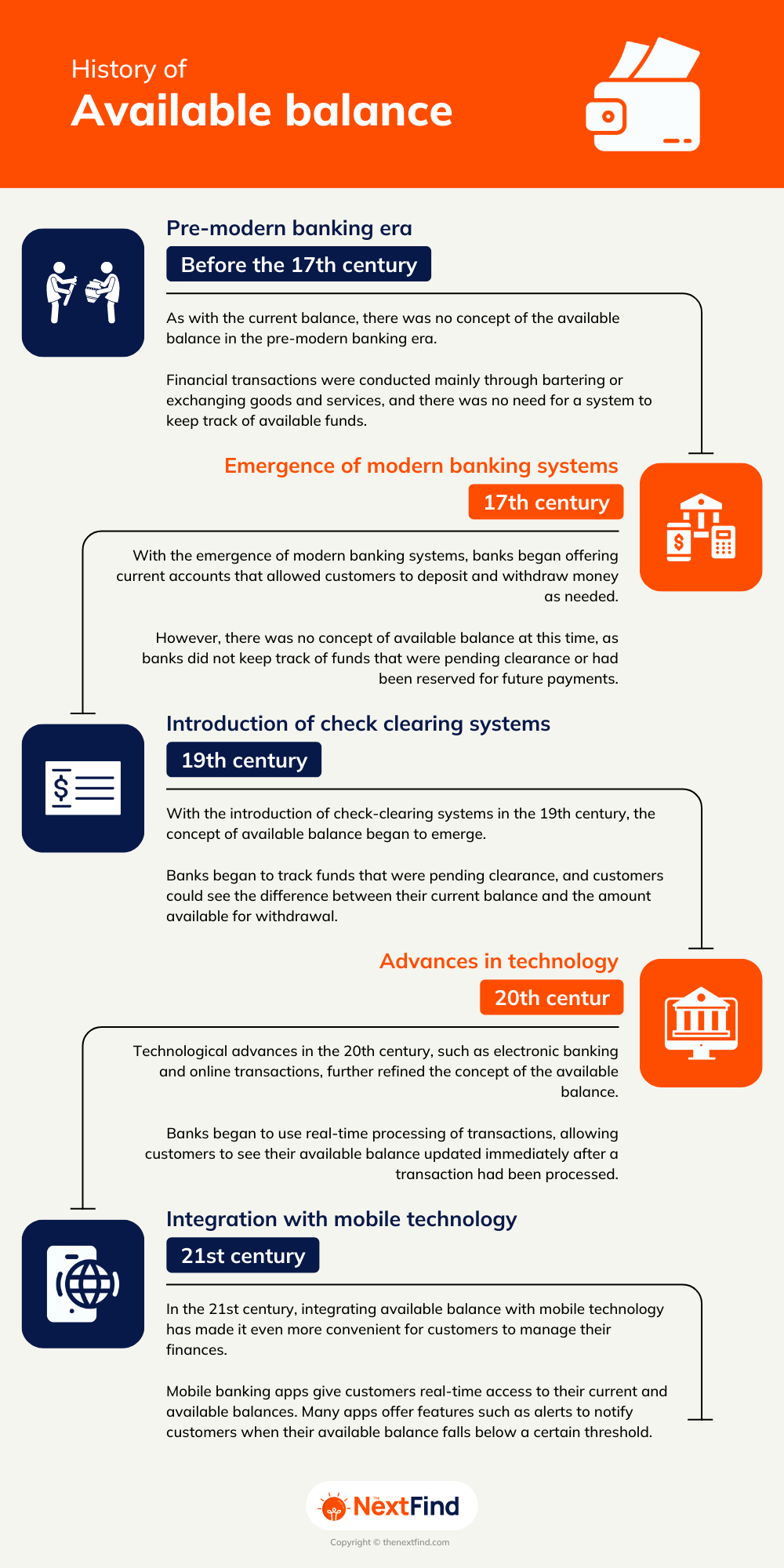

Knowing the difference between your current and available balance is essential to managing your finances. When in doubt, check your available balance to know what you can spend, but keep an eye out for future automatic payments or other transactions that could cause your account what is the difference between account balance and available balance to overdraft. While your available and current balances may be the same if you haven’t had any recent transactions, the two balances are often different. The reason for the difference is usually the amount of time it takes for a pending charge or deposit to clear your account.

The main differences between current balance and available balance

Your available balance is the total amount of money in your account that you can use for purchases and withdrawals, as it excludes pending transactions and check holds from your account balance. However, the available balance will not show checks that haven’t been cashed or deposits which haven’t posted. Current balances are less accurate in terms of what you have to spend because they don’t include pending transfers or payments that haven’t been completely processed yet. To make an informed decision on spending, check your available balance to ensure you have the money to cover your purchase to avoid overdraft fees. Your available balance is the amount in a bank account that can be taken out immediately, for things like debit card payments or withdrawals at an ATM.

Available Balance and Check Holds

That includes all the money that’s gone out—called debits—and the money that’s come in—called credits. But because it does not include your pending transactions, it’s not the most complete view of the money at your disposal. Outstanding checks, automatic payments you’ve set up, recent purchases or withdrawals that haven’t been processed won’t be included in your current balance. Because some transactions may not process until the next business day or even longer, your current balance may show a different amount than what you actually have available to spend. All this said, it is possible for the account balances to be the same.

Can I Use the Available Balance in My Checking Account?

That’s because your available balance includes some pending transactions. These could be things you’ve bought with your debit card that haven’t yet been processed. It shows the amount of money in your account, plus pending transactions.

Current Balance vs. Statement Balance on Credit Cards

However, overdraft protection often comes with fees, although they may be less than multiple NSF fees or merchant fees for a declined transaction. Some banks don’t charge for overdraft protection up to a certain amount. If you’re looking for a new bank, check the financial institution’s policy on overdrafts and insufficient fund fees in the account disclosures before signing up.

- One common reason for the confusion is that some shops and retailers show as different names.

- Remember to keep track of all your pre-authorized payments—especially if they pop up at different days of the month.

- Debit card transactions can take several days to go through and will show as pending until then.

- Your current balance shows the funds in a checking or savings account.

Or, if you know you’ll need $200 tomorrow, and your bank doesn’t know that, leave at least $200 in your available balance. If your utility payment is going through tomorrow morning, you want to make sure your balance is adequate. If you’re still not sure about a transaction, you can go here to raise a dispute. These are payments or deposits that haven’t yet been taken from or credited to your account. All Truist mortgage professionals are registered on the Nationwide Mortgage Licensing System & Registry (NMLS), which promotes uniformity and transparency throughout the residential real estate industry.

However, her available balance or the cash she has available to spend is only $1,275 ($2,000 – $800 + $100 – $25). However, if you’re trying to see what funds you currently have access to, the available balance is more reliable. Watching the available balance will help you only spend the money that’s currently in your account, and not accidentally overdraft based on pending transactions, such as a check that hasn’t processed yet. If you’re trying to budget for immediate purchases, the available balance is more reliable. Account Balance and Available Balance are two distinct concepts that provide different insights into your financial situation.